There is a growing concern over loan apps due to their potential for misuse of personal data and unethical practices, JUSTICE OKAMGBA writes

Technology has evolved to a point where we now have an app installed on our smartphones that allows us to borrow money and pay it back later. These apps are known as loan apps, digital lenders or online banks.

These technologies are only longer available in developed countries; they are now accessible in Nigeria.

Everybody enjoys the convenience of accessing financial services, but it comes with things to worry about – privacy concerns, the risk of falling prey to unscrupulous practices, and others.

Loan apps are mostly available on different platforms like the Google Play Store and Apple Store.

The number of licensed loan apps permitted to operate in Nigeria currently stands at 211, according to data from the Federal Competition and Consumer Protection Commission.

Out of these 211 digital lenders, 172 have obtained full approval, while the remaining 39 have conditional approvals. This marks a slight increase from the 204 licensed digital lenders reported in September.

This week, the Federal Competition and Consumer Protection Commission, the regulator, expressed concern over the growing trend of violations of its customers’ rights and said it would sanction them.

Google Play Store vs Apple Store

The process for listing apps on the Google Play Store is less rigorous than that of the Apple App Store. This has led to concerns about the presence of malicious apps.

The Google Play Store has a myriad of loan apps that promise quick and hassle-free access to funds. The eligibility criteria are often easier on the Play Store compared to what is available on the Apple Store.

Art Director at Wet Production, Michael Amerson said on Quora that Apple takes a proactive approach by manually checking the submissions of content before it is allowed on the App Store.

Emerson stated, “Google takes a more reactive approach to submissions. They allow you to submit and it gets automatically approved if later they check it, or it gets flagged for whatever reason, then they take it down until you fix it and resubmit.”

Last year, Google removed 43 Android apps with 2.5 million collective downloads from the app store. The apps were found to be violating Google Play Developer policy, loading ads while the device’s screen was off.

In November, the Chief Executive Officer of Google, Sundar Pichai, explained, “We’re trying to strike a balance. We believe in choice, so on Android we allow you to sideload and install additional applications.

He warns users, “This is like a seatbelt in a car, we are adding the protections, so you can use it safely. But, just like seatbelts, risks remain.”

Hidden interest rates

One of the primary concerns associated with many loan apps is the lack of transparency regarding fees and interest rates.

Some experts warn that loan apps can be dangerous and lead to a debt trap, especially if borrowers take out multiple loans and are unable to repay them on time.

A student, Mark Oghae, shared with The PUNCH the distressing account of how one of his relatives fell into a debt trap, culminating in a barrage of spam messages.

He explained, “When these loan apps first emerged, they would send broadcast messages to customers’ contact lists if they failed to meet their loan obligations. I’m not sure if they still employ this tactic today. At one point, I received a message from one of them claiming that my brother was an HIV carrier. I was genuinely shocked.”

Privacy and data security risks

A cybersecurity analyst, Anuoluwapo Olawuyi, in a note to The PUNCH, “I would advise people to always go through the permissions requested by these apps and question whether they are justified for the services provided.”

He said some of the loan apps required certain personal information that they needed such as contact lists, messages, and even access to the camera.

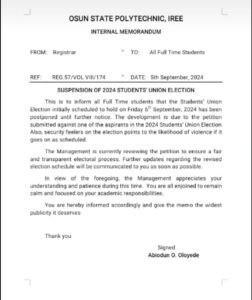

On August 17, the National Information and Technology Development Agency imposed a N10m fine on Soko Lending Company, a Nigerian online lending platform, for privacy invasion.

The penalty followed a string of complaints lodged against the company, citing unauthorised disclosures, neglect in safeguarding customers’ personal data, and defamation of character.

Almost a year ago, Google said loan apps were prohibited from accessing users’ photos and contacts effective from May 31, 2023. The policy was to address the rising privacy concerns from loan apps.

Tips

Experts also advise removing bloatware and redundant apps from your phone to free up space and enhance performance. Maintaining vigilance and taking necessary precautions are crucial to safeguard your personal information and financial security when using Android devices.

Key recommendations include reading reviews, verifying the legitimacy of an app, and thoroughly understanding its terms and conditions.

Users may compromise their privacy and expose themselves to potential identity theft without knowing.

It is essential to scrutinise the permissions requested by these apps and question whether they are justified for the services provided.

These steps are essential for protecting oneself from potential pitfalls associated with unscrupulous loan apps. By staying informed and vigilant, users can make educated decisions and steer clear of potential risks.