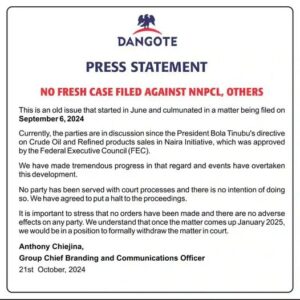

The Nigeria National Petroleum Company Limited (NNPCL) has revealed that its significant financial strain, including a debt of approximately $6 billion to suppliers, may impact the sustainability of petrol supply in the country.

According to reports, supply agents have become increasingly reluctant to provide fuel due to concerns over non-payment, leading to stock rationing and difficulties in securing supplies. At least five vessels destined for Nigeria have refused to discharge fuel to NNPCL due to fears of non-payment.

Despite a $300 million bailout from the Federal Government, NNPCL’s financial struggles persist, resulting in limited fuel availability at filling stations nationwide. This has led to long queues and independent marketers taking advantage of the situation by selling petrol at inflated prices, reaching as high as N950 per liter in some areas.

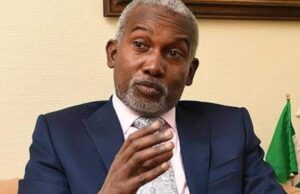

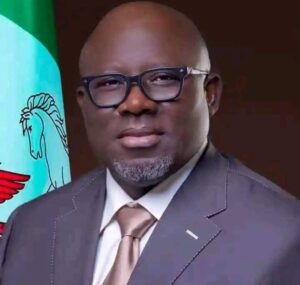

NNPCL’s Chief Corporate Communications Officer, Olufemi Soneye, acknowledged the company’s financial strain in a statement, saying: “NNPC Ltd has acknowledged recent reports regarding the company’s significant debt to petrol suppliers. This financial strain has placed considerable pressure on the company and poses a threat to the sustainability of fuel supply.”

The Federal Government is reportedly exploring options to address the situation.